Escrow Accounts

Your Escrow Account

An escrow account helps you manage large expenses like property taxes and insurance premiums, so you don’t have to budget and save for them separately.

Where can I find information about my escrow account deposits and disbursements?

- Your monthly billing statement will show all transactions related to the escrow account.

- Your escrow information, along with your other loan information is available through online banking.

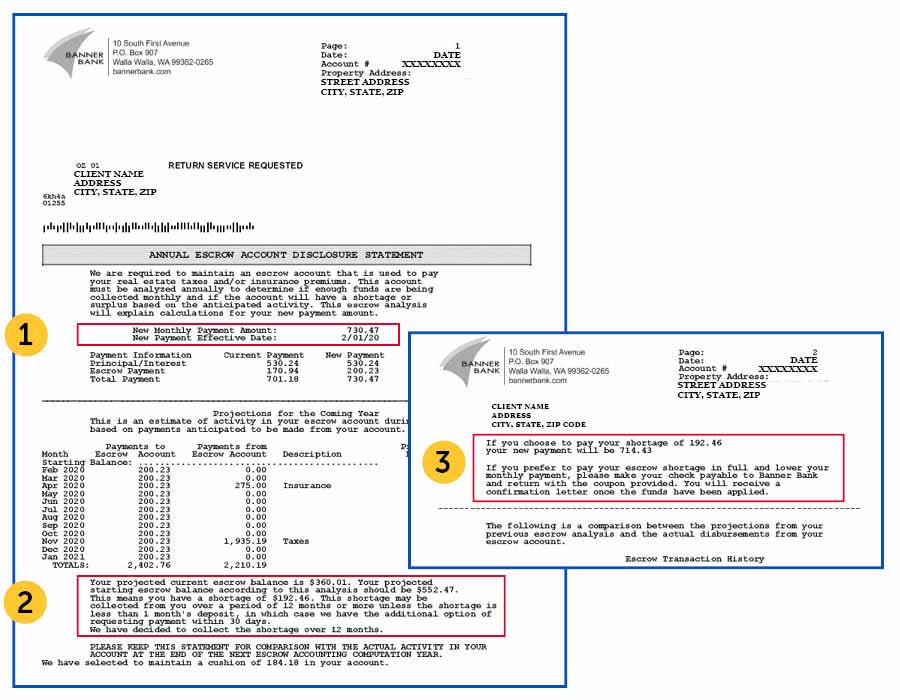

- Your annual escrow analysis statement includes previous escrow account activity, projected activity and information about any change to your monthly payment. If you signed up for eStatements, you will receive this analysis electronically. If you receive your mortgage statements in the mail, you will be mailed a copy. (See an example at the bottom of this page.)

How do you determine the amount of my escrow payment? Why did it change?

We use your property insurance and property tax information to establish your initial escrow payment. After that, we analyze your escrow account at least once a year to determine if your payment continues to match the amount needed for your insurance and tax payments. This process typically results in a decrease or increase to your monthly escrow payment, which means your monthly payment may change even if you have a fixed rate loan.

If my escrow amount changes, will my automatic payments change as well?

That depends. If you are already enrolled in autopay with Banner Bank, we will make the adjustment to the new amount. If you set up your payment yourself through Banner Bank Online Bill Pay or through another financial institution's bill pay service, you'll need to adjust your payment amount.

What is a shortage or deficiency and how can I pay them?

A shortage occurs when the projected escrow balance is less than the amount needed to pay insurance and/or tax payments. A deficiency occurs when there is a negative balance on your account. If you have a shortage or a deficiency, an amount necessary to make up that difference over 12 months will automatically be included in your new monthly payment. If you prefer, you can opt to pay the shortage amount in full by making an escrow-only payment within Banner Online Banking at bannerbank.com, or by sending us a check with the coupon provided. This will result in a lower monthly payment than you will have if you don’t pay the shortage in full at the time of your escrow analysis statement.

What is an overage? How will I be refunded?

If your escrow account is projected to have more than the minimum balance required, you have an overage. If the overage is $50 or more, we will send you a check. If it’s less than $50, we’ll apply it as a credit to your account by dividing it by 12 and reducing your monthly escrow payment by that amount.

If you receive a check for your overage, you may keep it or opt to apply it to your escrow account or principal. If you choose to apply it to your escrow account or principal, simply deposit the check and send a new check to:

Banner Bank

Attn: Mortgage Loan Servicing

PO Box 907

Walla Walla, WA 99362

Be sure to include your loan number and indicate whether you want the amount applied to your escrow or principal.

If you have past due payments, a check may not be issued until your account is current. Please reach out to us at 800-272-9933 ext. 75033 (8 a.m. – 5 p.m. PT weekdays) or MortgageHelp@bannerbank.com so we can assist you.

What’s a minimum balance?

Sometimes taxes and insurance are higher than expected. To plan for this, you're required to keep a minimum balance in your account at all times to ensure any unexpected increases are covered. Your required minimum balance is no more than 2 months of escrow payments.

What do I do if I receive a tax or insurance bill?

We receive bills directly from the property tax office and your insurance company and pay them on your behalf, so you don’t need to forward them to us unless you switch insurance companies. If you receive a notice for a past due amount, please call our Customer Service team at 800-272-9933 ext. 75031 as soon as possible. Please note that supplemental and occupancy taxes are not paid through your escrow account. You should make those tax payments directly to your county.

What if there are changes to my insurance policy or property parcel information?

Please send those to us at mortgagecustomerservice@bannerbank.com so we can update our records. Or mail to:

Banner Bank

Attn: Mortgage Loan Servicing

PO Box 907

Walla Walla, WA 99362

How do I add an escrow account for the payment of taxes and/or insurance?

Simply call us at: 800-272-9933 ext. 75031 (8 a.m. – 5 p.m. PT weekdays) or email us at MortgageCustomerService@bannerbank.com.*

- This section summarizes your new monthly payment and effective date.

- This section shows your escrow balance and if you have a shortage or overage.

- If you chose to pay your shortage in full, this area reflects your new payment.